0

ricardo created

3 Answer(s)

-

0

Can you describe in more detail what you want to do? What is the use case of it?

-

0

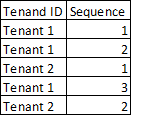

The country's legislation requires the generation of a receipt that contains a sequential number starting with 1 for each establishment. Where later a tax report will be issued and compared with each receipt generated. The sequential number cannot have gaps. This exclude generating a single sequence for all tenants.

-

0

Hi ricardo

I guess adding SequenceId field to your tenant table might meets your needs.