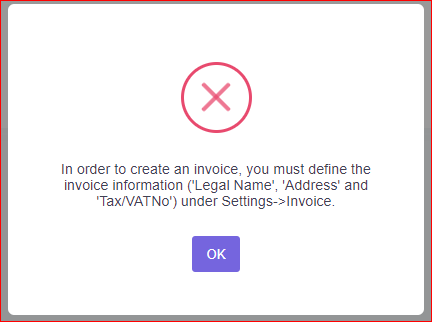

I am working on an app that will allow both individuals and businesses, however, there is no requirement in the US to have people, even businesses enter their Tax ID's such as Social Security Numbers or Employer Identification Number. This is how I interpret the requirement to view and Invoice is to enter either SSN or EIN, which many will not due simply because of PII and Health data being saved.

Is there an alternative or what options can be used, specifically to automate this? Perhaps there is some logic that can be applied for US users since may will not know what a Tax ID or VAT number is.

Thoughts? I was hoping not to have to modify the source code for Invoices as to avoid too many conflicts with future released.

Perhaps this is more similar to "Sales Tax"? Each state within the US will have it's own tax amount for sales of goods, and then each county and city will sometimes have additional sales tax amounts for purchases. So perhaps that is the meaning of this field...to use perhaps a Zip Code for the US to identify tax nexus?

Some direction would be helpful here, or ideas.

Thanks.

3 Answer(s)

-

0

Hi @exaas

Our implementation of invoicing is simple and doesn't handle the cases you shared. As far as I remember Tax ID/Vat Number field is optional, if not, we can change it to be optional in the original implementation. We can also add a Tax Amount / Rate field but it should be entered manually. Would that work for you ? If so, we can plan this for the following versions.

-

0

-

0

Hi,

Yes, you can do it on your project and you don't have to wait for us because we will do the same change. We will also add a new field for the VAT/TAX amount and VAT/TAX rate as optional items.